Dataset of the

Influence of the Local Labour Market on the Scale of Japanese Direct Investment

Enterprises in the Bohai Sea Rim Region (1990?C2016)

Wang, M. J.1* Ma, H. W.1 Shao, J.2 Gao, Y. F.3

1. School of Resources

Environment & Tourism, Capital Normal University, Beijing 100048, China;

2. PLA Strategic Support Force

Information Engineering University, Zhengzhou 450001, China;

3. Shanxi Urban & Rural

Planning and Design Institute CO., LTD., Taiyuan 030001, China

Abstract:

Authors analysed the

information from Overview of Inbound

and Outbound Enterprises (County Edition) published in 2016 to obtain

data on foreign direct investment (FDI) enterprises from Japan in the Bohai Sea

Rim region from 1990 to 2016. Moreover, the authors used statistical data from

Chinese Population Census by County (2010) and The Third Economic Census

Yearbook of five provinces (Beijing, Tianjin, Hebei, Liaoning and Shandong) to

obtain the influence dataset of the local labour market on the scale of

Japanese direct investment enterprises in the Bohai Sea Rim region (1990?C2016).

The dataset includes the result data and attached data. The result data include

(1) amounts of FDI from Japan used in China and proportions to total flows

from Asian countries, 2002?C2021; (2) number of Japanese enterprises in the

Bohai Sea Rim region and its proportion to the total number in China; (3)

geographical concentration degree of different industries in the Bohai Sea Rim

region in 2013; and (4) number of development zones and universities and colleges

offering a Japanese major on the county scale in the Bohai Sea Rim region in

2016. The attached data include (1) the attribute of Japanese enterprises in

the Bohai Sea Rim region; (2) the number of labour force and shared labour

force in the Bohai Sea Rim region in 2010; and (3) the dedicated labour force

in specific industries in the Bohai Sea Rim region in 2013. The dataset is

archived in .xls format and consists of one data file with a size of 234 KB.

Keywords: labour force scale; dedicated labour force; shared labour force;

Japanese transnational enterprises scale; Bohai Sea Rim region

DOI: https://doi.org/10.3974/geodp.2023.03.08

CSTR: https://cstr.escience.org.cn/CSTR:20146.14.2023.03.08

Dataset Availability Statement:

The dataset supporting this paper was published and is accessible through

the Digital Journal of Global Change Data Repository at: 3https://doi.org/10.3974/geodb.2023.10.01.V1 or

https://cstr.escience.org.cn/CSTR:20146.11.2023.10.01.V1.

1 Introduction

Since

1985, the focus of Japanese investment in Asia has been shifting to China. A

total of 52 Japanese multinational enterprises (JMEs) were operating in

mainland China in 1985, accounting for 1.7% of the total number of JMEs in

Asia. The number of JME in China increased to 6,091 in 2012 with the

corresponding proportion of 39.10%, surpassing the ??Four Asian Tigers?? with

4,135 and 26.50% and four ASEAN countries (Philippines, Indonesia, Malaysia and

Thailand) with 4,007 and 25.70%, thus becoming Japan??s largest investment

destination country in Asia. In 2016, the number and proportion of JMEs in

China were 6,363 and 38.5%, respectively. While the number of JMEs in China has

increased rapidly, the size of enterprises has declined significantly. From

1990 to 2015, the average employment size of JMEs at the national level in

China dropped from 1,018 to 80, and that in the Bohai Sea Rim region dropped

from 757 to 155[1]. Why is there such a significant change in JMEs

size? What are the dominant factors behind it? In other words, what factors

decide the size of local foreign direct investment (FDI) subsidiaries? These

problems need to be investigated in depth.

The investment of JMEs in

China is determined by the comprehensive balance of production supply factors

and product demand market factors. The former includes industrial tax policies,

labour force, human capital, raw materials, land cost, social capital and agglomeration

factors required by enterprise production, while the latter refers to market

demand factors for product sales, including the local market, the Japanese

market and the third- country market. While the role of the market increases,

like the vertical FDI facing Japan and the platform FDI facing the

third-country market, labour supply factors remain important and have undergone

significant changes. Firstly, the importance of a cheap labour force has

declined. Secondly, the proportion of human capital has remained steady at 3%

to 4%, showing a significant rise compared with the change in cheap labour.

Labour supply is still an

important factor for JMEs in China, which is why local labour supply factors

must have a key impact on the size of JMEs. What is the specific manifestation

of this impact? Existing research has not yet provided answers to this

question. Therefore, this study integrates the attribute information of JMEs in

the Bohai Sea Rim region with the labour force scale dataset of cities. This

dataset can be used to analyse the attribute characteristics of JMEs in the

Bohai Rim region and also provide explanations for the shrinking size of JMEs

in China.

2 Metadata of the Dataset

The metadata of the

Dataset of the influence of the local labour market on the scale of Japanese

direct investment enterprises in the Bohai Sea Rim region (1990?C2016)[2] are summarised in Table 1. It

includes the dataset??s full name, short name, authors, year, data format, data

size, data files, data publisher and data sharing policy, etc.

3 Data Sources and

Methods

3.1 Data

Sources and Processing

The enterprise data are

derived from the Overview of

Japanese Export and Import Enterprises

(2016), including the location of the enterprise,

employee size, subordinate sectors, date of establishment, business content and

Japanese investment proportion of JMEs in the

Table 1 Metadata summary of the Dataset of the influence of the local

labour market on the scale of Japanese direct investment enterprises in the

Bohai Sea Rim region (1990?C2016)

|

Items

|

Description

|

|

Dataset full name

|

Dataset of the

influence of the local labour market on the scale of Japanese direct

investment enterprises in the Bohai Sea Rim Region (1990?C2016)

|

|

Dataset short name

|

BohaiFDI_1990-2016

|

|

Authors

|

Wang, M. J. JDV-5082-2023,

School of Resources Environment & Tourism, Capatial Normal University,

maojunw@yeah.net

Ma, H.W. JDU-8149-2023,

School of Resources Environment & Tourism, Capatial Normal University,

mahuiwenchn@163.com

Shao, J. PLA Strategic

Support Force Information Engineering University, wjingshao@yeah.net

Gao, Y. F. JDV-6003-2023,

Shanxi Urban & Rural Planning and Design Institute CO., LTD.,

421739507@qq.com

|

|

Geographical region

|

Bohai Sea Rim region

|

|

Year

|

1990?C2016

|

|

Data format

|

.xlsx

|

|

Data size

|

234 KB

|

|

Data files

|

The result data include (1) amounts of FDI from

Japan used in China and its proportions to total flows from Asian countries,

2002?C2021; (2) number of Japanese enterprises in the Bohai Sea Rim region and

its proportion to the total number in China; (3) geographical concentration

of different industries in the Bohai Sea Rim region in 2013; and (4) number

of development zones and universities and colleges offering a Japanese major

on the county scale in the Bohai Sea Rim region in 2016. The attached data

include (1) the attribute of Japanese enterprises in the Bohai Sea Rim

region; (2) the number of labour force and shared labour force in the Bohai

Sea Rim region in 2010; and (3) the dedicated labour force in specific

industries in the Bohai Sea Rim region in 2013

|

|

Foundation

|

National Natural

Science Foundation of China (41771183)

|

|

Data publisher

|

Global Change Research

Data Publishing & Repository, http://www.geodoi.ac.cn

|

|

Address

|

No. 11A, Datun Road,

Chaoyang District, Beijing 100101, China

|

|

Data sharing policy

|

(1) Data

are openly available and can be free downloaded via the Internet; (2) End

users are encouraged to use Data subject to citation; (3)

Users, who are by definition also value-added service providers, are welcome

to redistribute Data subject to written permission from the GCdataPR Editorial

Office and the issuance of a Data redistribution license; and (4)

If Data

are used to compile new datasets, the ??ten per cent principal?? should be

followed such that Data records utilized should not

surpass 10% of the new dataset contents, while sources should be clearly

noted in suitable places in the new dataset[3]

|

|

Communication and

searchable system

|

DOI, CSTR, Crossref, DCI, CSCD, CNKI,

SciEngine, WDS/ISC, GEOSS

|

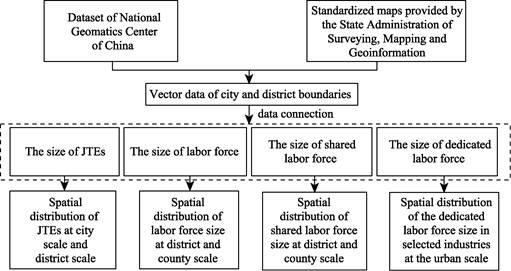

Figure

1 Technical route of the dataset development

Bohai Sea Rim region. On the basis of the data

validity, we select a total of 681 Japanese subsidiaries in 28 prefecture-level

cities of the Bohai Sea Rim region. The labour force scale data and other influencing

factor data sources are shown in Table 2.

Table

2 Sources of data on factors influencing the

local labour market on the scale of JMEs

|

Variable

|

Definition of index

|

Year

|

Source

|

|

Dependent variable

|

Employee size

|

Enterprise employees (logarithm)

|

2016

|

Overview of Japanese Export & Import Enterprises (2016) [1]

|

|

Independent variables

|

Labor supply size

|

Population with labour capacity of county (logarithm)

|

2010

|

County Data in Population Census of China (2010) [4]

|

|

Shared labour size

|

Migrant population of county (logarithm)

|

2010

|

County Data in Population Census of China (2010) [4]

|

|

Dedicated labour size

|

Number of employees in the subordinate industry of urban enterprises

(logarithm)

|

2013

|

The Third China Economic Census Yearbook [5?C9]

|

|

Control variables

|

Parent enterprise attributes

|

Listed enterprise or not

|

Listed =1, unlisted =0

|

2016

|

Overview of Japanese Export & Import Enterprises (2016) [1]

|

|

Local initial investment or not

|

Initial investment=1,

Non-initial investment=0

|

2016

|

Overview of Japanese Export and Import Enterprises (2016) [1]

|

|

Subsidiary attributes

|

Age of enterprise

|

Survival age as of 2016

|

2016

|

Overview of Japanese Export & Import Enterprises (2016) [1]

|

|

Mode of joint venture and sole proprietorship

|

Joint venture=0,

Sole proprietorship=1

|

2016

|

Overview of Japanese Export & Import Enterprises (2016) [1]

|

|

Industry category

|

Services=1, manufacturing=0

|

2016

|

Overview of Japanese Export & Import Enterprises (2016) [1]

|

|

Market structure

|

Local market orientation

|

Urban social consumption retail sales (logarithm)

|

2016

|

Statistical yearbooks of Chinese cities

|

|

Foreign market orientation

|

County export volume (logarithm)

|

2016

|

Statistical yearbooks of Chinese cities

|

|

Spatial agglomeration

|

Total size of local agglomeration

|

Number of enterprises at district or county scale (logarithm)

|

2016

|

Statistical yearbooks of Chinese cities

|

|

Size of JMEs

|

Cumulative number of JMEs at district or county scale

|

2016

|

Overview of Japanese Export & Import Enterprises (2016) [1]

|

|

Cultural factors

|

Supply of Japanese-speaking labour force

|

Number of universities and colleges offering a Japanese major in

cities

|

2016

|

Collected by the authors

|

|

Location factors

|

Development zone

|

Number of development zones at provincial, district or county scale

|

2016

|

China Development Zone Audit and Announcement

Catalog (2018 Edition)

|

|

Urban type

|

Central urban area=1, non-central urban area=0

|

2016

|

Determined according to the planning horizon of

each city

|

3.2 Technical Route

The

technical route for producing data on the size of JMEs in the Bohai Sea Rim

region, local labour market data and their spatial distribution is shown in

Figure 1.

(1) The boundary vector data

of cities, counties and districts in the Bohai Sea Rim Region are collected,

mapped and integrated to form basic geographic boundary data.

(2) The attribute data of the scale of JMEs and the scale of labour force in

the Bohai Sea Rim region are collected and organised. Then, the attribute data

are connected with the boundary vector data of counties and districts in ArcGIS

based on the same fields to complete the spatial distribution map of the scale

of JMEs and the scale of the local labour market.

4 Data Results and

Validation

4.1 Data

Composition

The dataset of the

influence of the local labour market on the scale of Japanese direct investment

enterprises in the Bohai Sea Rim region contains three main sections: information

on the attributes of JMEs in the Bohai Sea Rim region, the size of the labour

force in each city in the Bohai Sea Rim region and statistics on other control

variables.

4.2 Data Results

4.2.1 Spatial Distribution of the Size of JMEs in the

Bohai Sea Rim Region

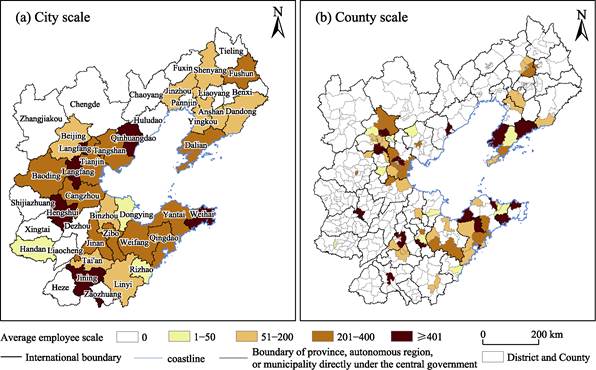

As shown in Figure 2,

at the county and city scale, the size of JMEs in the central city is

relatively smaller than those in distant suburbs. At the city scale,

Qinhuangdao, Jining, Langfang, Weihai and Hengshui have the largest JME

employment size with more than 400 people. The JMEs employment sizes of Tai??an,

Handan, Dongying, Linyi and other cities are the smallest. The common characteristics of the latter cities is that they have few

JMEs (less than four). The enterprise size

of JMEs is related to their subordinate industries. The required minimum

economic scale varies according to subordinate industries.

Figure 2 Map of spatial distribution of the average employee size of JMEs in the Bohai

Sea Rim region

Despite significant

differences in the average size of JMEs among cities, the average employment

sizes in Beijing?CTianjin?CHebei, Liaoning and Shandong are 256, 249 and 280,

respectively. Variance analysis shows that F (2.305) and SIG (0.101) indicate

failure to pass the test at 0.1 level. Judging from

this point of view, the attributes influencing the size of JMEs are more urban

attributes than regional attributes. A few differences will certainly exist

within each region. For instance, the coefficients of variation in

Beijing?CTianjin?CHebei and Shandong province are 2.111 and 2.018, respectively.

In Liaoning province, however, the average size and coefficient of variation of

JMEs are 249 and 1.739, respectively, while the average JMEs size in other

Liaoning cities is 100?C200, except for Dalian with more than 200 people.

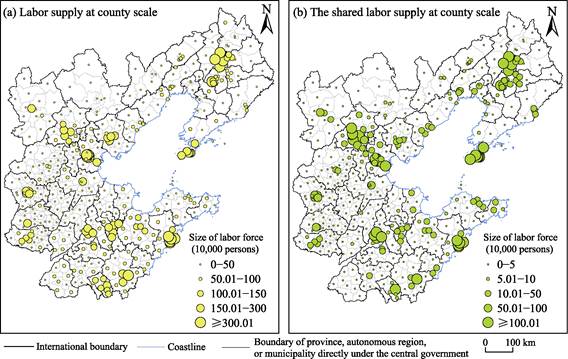

4.2.2 Spatial Distribution of the Size of the Labour

Force in the Bohai Sea Rim Region

(1) Distribution characteristics of labour force

size and shared labour force size

The labour force

scale and the shared labour force scale show similar spatial distribution

characteristics (Figure 3), with Beijing, Tianjin, Shenyang, Dalian, Qingdao

and Jinan being the main labour supply places in the Bohai Sea Rim region. In terms of the

median size of local labour force, at the city scale, the Beijing?CTianjin?CHebei

region is the largest, followed by Shandong province. At the county scale,

Shandong province is the largest, followed by the Beijing?CTianjin?CHebei region. The median shared

labour force size is the opposite of the local labour force. The dispersion degree of the labour

force size in Beijing?CTianjin?CHebei at the urban scale is obviously lower than

at district or county scale, but little difference exists between Shandong and

Liaoning. The dispersion of the shared labour size at the urban scale is less

than that at district or county scale.

Figure 3 Map of spatial differentiation of labour force size and shared labour force

size in the Bohai Sea Rim region

(2) Distribution characteristics of the dedicated

labour force size

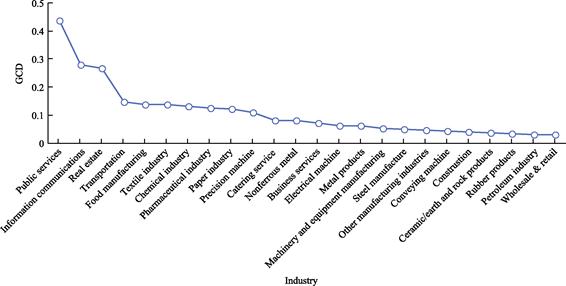

Transnational

enterprises adopt spatial synergetic distribution of employment demand and

supply with reference to the advantageous sectors of the local city and their

own subordinate sectors. Enterprises can share the spillover benefit of the

dedicated labour market when they match the supply and demand of the dedicated

labour force. The matching degree between enterprises and labour force is

measured by the size of employees in the subordinate sectors of specific JMEs

in local cities. The

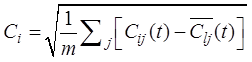

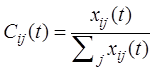

geographical concentration index can be calculated by using Equation (1).

(1)

(1)

(2)

(2)

(3)

(3)

where, represents the geographical

concentration degree of industry i,

represents the geographical

concentration degree of industry i,  represents the employees of industry i in city j,

represents the employees of industry i in city j,  represents the share of employees of

industry i in city j,

represents the share of employees of

industry i in city j,  represents the share of total

employees in city j and m is the number of cities.

represents the share of total

employees in city j and m is the number of cities.

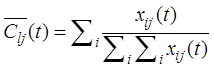

Real estate,

information service and public service have a high GCD, while wholesale and

retail and the petroleum industry have a low GCD (Figure 4). The percentages of

JMEs in chemical industry (7.34%), machinery and equipment manufacturing

(10.43%), electrical machinery manufacturing (12.04%), conveying machinery

manufacturing (10.87%), wholesale and retail (19.82%) and transportation

(5.73%) all exceed 5% in the Bohai Sea Rim region. The chemical industry agglomerates in Tianjin

and Shijiazhuang. The conveying machinery manufacturing industry agglomerates

in Beijing and Tianjin, while the electrical machinery manufacturing industry

agglomerates in Beijing, Tianjin and Shenyang. Machinery and equipment

manufacturing is widely dispersed in Shandong Peninsula, Shenyang, Dalian,

Beijing and Tianjin. Wholesale and retail and transportation highly agglomerate

in Beijing and Tianjin (Figure 5). Obviously, each city has different

advantageous sectors. The matching degree between supply and demand of the

dedicated labour force directly affects JMEs?? location selection and size.

Figure 4 Geographical concentration degree of different industries in the

Bohai Sea Rim region

4.2.3 Determinants of the

Size of JMEs in the Bohai Sea Rim Region

This

paper constructs a model of factors that influence the size of JMEs from the

perspective of the local labour force. This model consists of the size of the

labour force supply, the size of the shared labour force, the size of the

dedicated labour force, enterprise attributes and city attributes. The variable

indicators are detailed in Table 2.

The following findings were derived: (1) Whether

the labour force size and shared labour force size are introduced separately or

enterprise attributes and urban attributes are introduced successively, the

high wage cost caused by the increase in the labour pool size restrains the

expansion of enterprise size. (2) The specialised sectors in local cities have

a significant promoting effect on the average JMEs employment size in the same

industry. The effective matching between the

employment demand of enterprises and the size of specialised urban

talents benefits the expansion of enterprise size. (3) The scale of the local

labour force has a significant and robust inhibiting effect on the scale of

JMEs in the two phases before and after 2001. However, the inhibiting effect of

the scale of the shared labour force and the expansion effect of the scale of

the dedicated labour force are not robust in the two phases. (4) The size of

JMEs is jointly influenced by the attributes of the parent and subsidiary

enterprises, and the direction of impact and the strength ranks of the

variables generating significant impact on enterprise size remain stable and

consistent. Specifically, the listed parent enterprise tends to encourage the

local subsidiaries to expand their size, but not significantly. If the

investments of JMEs in the Bohai Sea Rim region are the first ones, most of

them are tentative small-scale investments. The size of joint venture is larger

than that of sole proprietorship. The longer the local subsidiary exists, the

larger the size of the enterprise is. The size of the service industry is

significantly smaller than that of manu-

Figure 5 Map of spatial distribution of dedicated labour force in specific industries in

the Bohai Sea Rim region

facturing industry. (5) Third, the attributes of the local city

have a significant impact on the size of JMEs. While the size of JTE is

essentially the result of the joint effect of the enterprise and the local

city, the position of the local city is indispensable. However, the enterprise

agglomeration in local cities and the succeeding agglomeration effect of JMEs

have opposite influencing directions; the former is a positive incentive

effect, and the latter is a negative inhibiting effect. The preferential

policies of the development zone promote not only local agglomeration of JMEs

but also the expansion of JMEs size. The smaller the enterprise, the more

sensitive it is to the Japanese-speaking labour supply provided by the local

city.

5 Discussion and

Conclusion

Taking the Bohai Rim

region as an example, this paper analyses the combined effects of labour pool

factors, city attribute factors and enterprise attribute factors that affect

the size of Japanese enterprises. The following conclusions were derived:

(1) The local labour

force and the shared labour force have the same inhibiting effect on the size

of enterprise due to the labour cost increase brought by its expansion.

However, the size of the dedicated labour force has a significant incentive

effect on the size of the enterprise.

(2) Over time, the

strengthening of the inhibiting effect of the size of the shared labour force

and the weakening of the expansion effect of the size of the dedicated labour

force together led to the shrinking of the size of JMEs in the Bohai Sea Rim

region.

(3) The size of JMEs

is simultaneously affected by the attributes of the parent and subsidiary

enterprises. Among these attributes, age has the strongest positive promoting

effect on the size of an enterprise, while the subordinate industries of the

enterprise, mode of sole proprietorship and initial investment of the parent

enterprise have an inhibiting effect.

(4) Among the

attributes of the city, the development zone and local agglomeration have a

significant and steady promoting effect on enterprise size. The smaller the

enterprise is, the more sensitive it is to the supply of Japanese-speaking

labour provided by cities. Thus, the latter??s supply can promote local

agglomeration of small Japanese enterprises.

This dataset can

provide data support for relevant scholars to study the scale of JMEs in the

Bohai Sea Rim region. In addition, as the trend of anti-globalisation becomes

increasingly prominent, various countries are adopting subtle attitudes towards

globalisation and international cooperation. As for FDI, as the carrier of

globalisation, is it better to increase investment or to initiate divestment?

Is expanding or shrinking better? Is spatial agglomeration or diffusion

preferable? Which one between integration or

decentralisation of the industrial chain links should be adopted? All these

questions will to a certain extent affect the development of the local FDI

enterprise. The

dataset can contribute to the change tracking study described above.

Author Contributions

Shao, J.

And Gao, Y. F. collected and processed the data; Wang,

M. J. and Ma, H. W. wrote the data paper.

Conflicts of Interest

The

authors declare no conflicts of interest.

References

[1] Harushi shibaita. Overview

of Inbound and Outbound Enterprises (Country Edition) [M]. Tokyo: Toyo

Keizai, 2019.

[2] Wang, M. J., Ma, H.W., Shao, J., et al. Influence dataset of the local

labor market on the scale of Japanese Direct investment enterprises in Bohai

Sea Rim region (1990?C2016) [J/DB/OL].

Digital Journal of

Global Change Data Repository, 2023. https://doi.org/10.3974/geodb.2023.10.01.V1.

https://cstr.escience.org.cn/CSTR:20146.11.2023.10.01.V1.

[3] GCdataPR Editorial Office. GCdataPR data sharing policy [OL].

https://doi.org/10.3974/dp.policy.2014.05 (Updated 2017).

[4] Population Census Office under the State

Council, Department of Population and Employment Statistics National Bureau of

Statistics. Tabulation on the 2010 Population Census of the

People??s Republic of China by County [M]. Beijing: China Statistic

Press, 2012.

[5] Leading Group Office of the Third National

Economic Census of Beijing, Beijing Municipal Bureau of Statistics, Survey

Office of the National Bureau of Statistics in Beijing. Beijing

Economic Census Yearbook 2013 [M]. Beijing: China Statistic Press, 2015.

[6] Leading Group Office of the Third National

Economic Census of Tianjin, Tianjin Municipal Bureau of Statistics. Tianjin Economic Census Yearbook 2013 [M]. Beijing: China

Statistic Press, 2015.

[7] Leading Group Office of the Third National

Economic Census of Hebei Province, Hebei Provincial Bureau of Statistics. Hebei Economic Census Yearbook 2013 [M]. Beijing: China

Statistic Press, 2015.

[8] Leading Group Office of the Third National

Economic Census of Liaoning Province, Liaoning Provincial Bureau of Statistics.

Liaoning Economic Census Yearbook 2013 [M]. Beijing:

China Statistic Press, 2015.

[9] Leading Group Office of the Third National

Economic Census of Shandong Province, Shandong Provincial Bureau of Statistics.

Shandong Economic Census Yearbook 2013 [M]. Beijing:

China Statistic Press, 2015.