Geographic Information Dataset of Urban Housing

Price Changes in the Yangtze River Delta Region (2008?C2018)

Ma, Y. Z.1,2

Li, X. L.1,2 Song,

W. X.1,3*

1. Nanjing Institute of Geography and Limnology, Chinese

Academy of Sciences Nanjing 210008, China;

2. University of Chinese Academy of Sciences, Beijing

101408, Beijing, China;

3. Nanjing Institute of Geography and Limnology, Key Laboratory

of Watershed Geographic Sciences, Chinese Academy of Sciences, Nanjing 210008,

Jiangsu, China

Abstract: To study the factors influencing urban

housing price changes in the Yangtze River Delta region, the authors used the

national real estate transaction information platforms, such as Fangtianxia

(www.fang.com) and 365 Taofang.com (www.house365.com), to search for data relevant

to this research objective. Through data collection and analysis, house prices

in 327 districts or counties in 41 cities in the Yangtze River Delta from 2008

to 2018 were itemized and reorganized, namely as the Geographic Information Data Set of Urban Housing Price Changes in the

Yangtze River Delta Region (2008?C2018). This data set includes: (1) city

and county boundary data in the region; (2) house prices in 41 cities and 327

districts or counties in the region from 2008 to 2018. The data show that house

price is the monetized expression of the abundance of resources such as urban

economy, human, society, and administration. The regional house price

differentiation is a comprehensive indicator of differences in the ability of

urban dominating resources. It is difficult for housing prices in the districts

or counties of the Yangtze River Delta to achieve "club convergence"

in a short period of time, so the gap in housing prices between core cities

(e.g., Shanghai, Nanjing, Hangzhou) and other cities may continue to expand.

The data set is stored in .xls and .shp formats and consists of three data

files with a total volume of 14 MB (compressed to 1 file, 4.37MB). The research

results based on this data set have been published in Geography Research, 2018,

volume 37, issue 1.

Keywords: data of counties and districts;

data of cities; housing price; Yangtze River Delta Region

1 Introduction

Since the implementation of

the urban housing system reform in 1998, urban housing prices in China have

been increasing steadily. The problem of high housing prices has attracted broader

attention. Especially so for the megacities, where the excessive growth rate

causes the housing price risk to rise, and real estate bubbles become common.

House prices depend on the level of development of a

region or country, including its economic, social, political dimensions and so

on, which together affect the development and stability of a given region (or

country). In the process of rapid social development and urban renewal, housing

prices can vary greatly according to differences in the various resource

allocation capabilities among cities, and these price gaps are currently

widening. Usually, the index system of such influencing factors of housing

price differentiation is based on supply?Cdemand theory [1?C2] and

urban hedonic price theory [3?C4]. The first theory explores the

influencing factors of urban housing price differentiation from the perspective

of equilibrium prices of housing supply and the second the demand and location equilibrium

between manufacturer and consumer [5?C6]. Currently, scholars at home

and abroad have focused on the specific factors that stem from aspects of the

economy, society, manpower, and administration and that affect such price

differentiations. They mainly include urban location and administrative level,

population structure, wealth level of residents, mileage of traffic, immigration

population scale, direct foreign investment, urban center, public services

within cities, and traffic conditions, among others. [8-13]

Housing prices in the Yangtze River Delta region are

one of the highest in the country, and they are increasing rapidly. The

regional housing price difference is significant, in terms of its high research

value. As an example of an integrated area, the Yangtze River Delta region has

the advantages of a developed economy: population concentration, strong public

service ability, and convenient transportation. It also benefits from close

inter-city links, frequent factor mobility, and fewer obstacles. Although the

level of integration among cities in the Yangtze River Delta region is high,

the type of cities are various. This data set thus explores the spatial pattern

and housing price differences in the Yangtze River Delta region, which can provide

a new perspective on housing price differentiation in this region, one that may

contribute to adjustments in housing development policy.

2 Metadata of the Dataset

The name, author,

geographical region, data time, time resolution, data set composition, data

publishing and service platform, data sharing policy, and other relevant

information of the dataset[14] are shown in Table 1.

Table 1 Metadata

summary of Geographic Information Data

Set of Urban Housing Price Changes in Yangtze River Delta Region (2008?C2018)

|

Items

|

Description

|

|

Dataset full name

|

Geographic

Information Dataset of Urban Housing Price Changes in Yangtze River Delta Region

(2008?C2018)

|

|

Dataset short

Name

|

HousingPriceYangtzeRD_2008?C2018

|

|

Authors

|

Ma Yuzhu, Z-2985-2019, Nanjing Institute of Geography and Limnology??mayuzhu17@mails.ucas.ac.cn

|

|

Li Xiaoli, Z-2992-2019, Nanjing Institute of Geography and Limnology??lixiaoli17@mails.ucas.ac.cn

|

|

Song Weixuan??N-1173-2018??Nanjing

Institute of Geography and Limnology??wxsong@niglas.ac.cn

|

|

Geographical

region

|

The Yangtze River

Delta Region (30??43'20"N?C33??5'16"N;

119??15'36"E?C120??29'0"E)

|

|

Year

|

2008?C2018

|

Time resolution 1 year

|

|

|

Data format

|

.shp and .xls

|

Data size

4.37 MB (after compression)

|

(To be continued on the next page)

|

Items

|

Description

|

|

Data files

|

1. City and county boundary data in the Yangtze River Delta region; 2.

Housing price data of 41 cities and 327 districts or counties in the Yangtze

River Delta region from 2008 to 2018 (Including revoked zones and functional

zones).

|

|

Foundation

|

National Natural Science Foundation Project (41771184)

|

|

Data publisher

|

Global Change Research Data Publishing & Repository,

http://www.geodoi.ac.cn

|

|

Address

|

No. 11 Datun Road, Chaoyang District, Beijing 100101, China

|

|

Data sharing policy

|

The "data" of Global Change Research Data Publishing &

Repository includes metadata (Chinese and English), entity data (Chinese and

English), and data papers published through the Journal

of Global Change Data & Discovery (Chinese and English). Its

sharing policy is as follows: (1) Data are freely available to the whole

society through the Internet system in the most convenient way, and users can

browse and download it for free; (2) Users need to label data sources in

reference documents or other appropriate places according to the citation format;

(3) Users of value-added services or other who disseminate "data"

in any form (including through computer servers) need to sign a written

agreement with the editorial department of the Journal of Global Change Data & Discovery (Chinese and English)

to obtain permission; (4) Authors who extract some records from

"data" to create new data need to follow the 10% citation

principle, which means that the extracted data records are less than 10% of

the total records of the new data set, and the extracted data records need to

be labeled with data sources [15]

|

|

Communication and searchable system

|

DOI, DCI, CSCD, WDS/ISC, GEOSS, China GEOSS

|

3 Data Sources

and Research Areas

3.1 Data Sources

The vector data of

administrative boundary came from the diva-gis website (www.diva-gis. org). Individual

obsolete boundary data have been readjusted according to the latest administrative

divisions, which are inquired in the websites of municipalities. Housing price

data came from national real estate trading information platforms, such as

Fangtianxia (www.fang.com) and 365 Taofang (www.house 365.com). The data in

these websites were collected by professional information collectors, or

provided by developers and intermediaries. After that, the collected data were

reorganized, filtered, with duplicates and outlier data eliminated, so as to compile timely and comprehensive

housing price data set. The China Index Academy also uses the data from

Fangtianxia as original data (details can be seen on the official website: industry.fang.com),

so we presumed the data have good reliability. It should be pointed out 10

revoked or important functional areas have been eliminated from the data (in

Excel), leaving 317 districts and counties in the vector data.

3.2 Research Areas

This data set includes three

provinces and one province-level municipality

in the Yangtze River Delta: Shanghai, Jiangsu, Zhejiang, and Anhui, totaling 41

cities and 327 districts or counties. Because of the significant differences in

economic power, population, and traffic conditions among the cities, especially

between core cities such as Shanghai, Nanjing, Hangzhou and other cities, this

may cause spatial heterogeneity in overall housing prices[16]. There're

also certain gaps in the development level among downtown areas, suburbs, and

counties, so there may be obvious spatial differentiation of housing prices in a

city as well.

3.3 Data Development

Technology Route

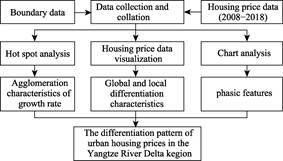

Technical route: To study the

housing price differentiation patterns in the Yangtze River data, firstly, we

compared the mean value of housing prices in the data with those of the whole

co- untry in 2008?C2018 and plotted them, and then summarized the

characteristics of each stageof growth. Then we conducted a three-stage

analysis of the growth rate in housing prices to identify the agglomeration

characteristics. Finally, we visualized the data, trying to ascertain the

overall and local differentiation pattern of urban housing prices, and proposed

the future directions for follow-up research.

4 Data Composition and Results

4.1 Dataset Composition

|

Figure 1 Technology Roadmap

|

Geographic Information Data

Set of Urban Housing Price Change in Yangtze River Delta Region (2008?C2018) includes

two parts: 1. The administrative boundary of the Yangtze River Delta region,

for which the file format is .shp; 2. The housing price data of the cities and

counties in the Yangtze River Delta region, for which the file format is .xls.

4.2 Data Results

|

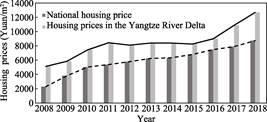

Figure

2 Periodic growth trends in housing

prices of the Yangtze River Delta region

|

The

overall growth trend for urban housing prices in the data set appears periodic

(Fig. 2), which is similar to China??s national pattern. There're three stages from 2008 to 2018. The first stage

lasted from 2008 to 2011, when housing prices rose rapidly; the second stage was

from 2011 to 2015, when housing prices remained stable; the third was from 2015

to 2018, marked by housing prices re-entering a period of faster growth.

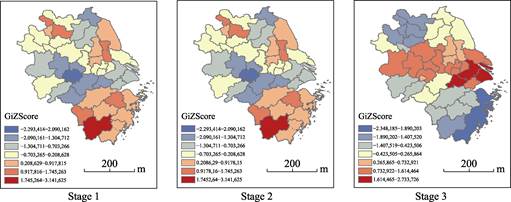

For these three stages, an analysis of housing price growth rates is

shown in Fig. 3.This revealed that the high-value growth rate was concentrated

in Zhejiang, especially near Wenzhou, in the first-stage; the second-stage high

value was concentrated in the Anhui and northern Jiangsu; that for the

third-stage was around core cities, such as Shanghai, Nanjing, Hangzhou and Hefei.

Based on the data of 327 districts or counties in 2008?C2018, housing

prices in the Yangtze River Delta generally showed a steady upward trend.

Notably, growth for 2012?C2015 was relatively stable, when house prices rose by

an average of just 1.36%. By contrast, in 2008?C2011 and 2016?C2018, housing

prices rose rapidly, with average increases of 18.49% and 16.21%, respectively.

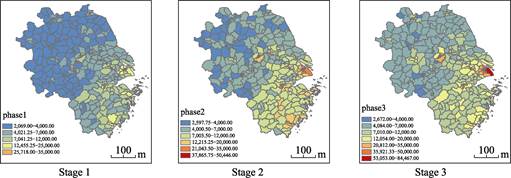

As Fig. 4 shows, high housing prices mainly occurred in the central urban areas

of Shanghai, Nanjing and Hangzhou. The highest value was found in the Shanghai

Jing'an District in 2018, where the house price exceeded 90,000 yuan/m2,

and the maximum increase and the fastest growth rate occurred respectively in

the Shanghai Jing'an District and Hefei Binhu New District. In 2008, only 30 areas

had housing prices that exceeding 10,000 yuan/m2, which accounted

for only 9% of the total. By 2018, however, 163 areas attained housing prices

of more than 10,000 yuan/m2, accounting for half of the total.In

northern Jiangsu and Anhui (except for Hefei), the prices of most areas have

increased, but they have not yet surpassed the 10,000 yuan/m2; this

exemplifies the geographic difference between the north and south in housing

prices from the overall pattern of housing pric es in the data. The difference

in housing prices between the counties and districts in a given city of the

Yangtze River Delta was also significant, and this gap continues to widen. In

2008, the greatest gap was in Shanghai, where it exceeded 22,000 yuan/m2;

by 2018, this gap coming close to 80,000 yuan/m2. Over this period,

Chizhou, which had the smallest gap in 2008, also expanded from 904 yuan/m2

to 3,466 yuan/m2, reflecting the partial differentiation

pattern of urban housing prices in the Yangtze River Delta.

Figure 3 Three-stage hotspot analysis of housing

price growth rates in the Yangtze River Delta region

Figure 4 Distribution map of housing prices of

districts or counties in the Yangtze River Delta Region

5 Discussion

and Conclusion

Against

the background of rapid housing price growth, the greater risks, and the significant

differences, this data set aimed at providing new research materials and

perspectives for the spatial differentiation pattern, mechanisms, and effects

of housing prices in the Yangtze River Delta region. According to the data visualization

results, house prices in the region have risen steadily over 2008?C2018, showing

periodic characteristics and overall and local differences in the spatial distribution.

This study only combined house price data with vector data, and then developed

a simple spatial analysis and description. Hence, it didn't consider endogenous factors, such as economy,

society, administration and so on, and external factors, such as housing

policy, economic situation, and spillover effects[17?C18], to analyze

the data in depth. Therefore, this data set provides a readily accessible

database for future in-depth research on housing price trends. But the urban

endogenous and external factors that can jointly affect housing price

differentiation need to be further collected and collated. The next step should

focus on data on the impact mechanisms and spatial effects underpinning the differentiation

in housing prices that we revealed here. This enabled us to better explore the

reality and critical factors governing such differentiation in the region, to

understand housing prices in various cities, to provide a reference for the

government to implement differentiated housing development policies, and to

motivate commitment towards contributing to the healthy and stable operation of

the real estate market. At the same time, we could also explore the mutual

feedback mechanism(s) between housing price differentiation and the integration

process, to provide fresh ideas for high-quality integration from the

perspective of housing prices.

Author

Contributions

Ma, Y. Z.

analyzed data; Li, X. L. collated the housing price data and boundary data;

Song, W. X. was responsible for the overall design of the dataset and its

development and also collected housing price data. Ma, Y. Z. and Li, X. L.

wrote the data paper

References

[1]

Davidoff T. Labor income,

housing prices, and home ownership [J]. Journal

of Urban Economics, 2006, 59(2): 209-235.

[2]

Chen, J. H., Guo, F., Wu, Y.

One decade of urban housing reform in China: urban housing price dynamics and

the role of migration and urbanization, 1995-2005 [J]. Habitat International, 2011, 35(1): 1-8.

[3]

Gabriel, S. A., Mattey, J. P.,

Wascher, W. L. Compensating differentials and evolution of the quality-of-life

among U.S. states [J]. Regional Science

and Urban Economics, 2003, 33(5): 619-649.

[4]

Haurin, D. R., Brasington, D.

School quality and real house prices: inter- and intrametropolitan effects [J].

Journal of Housing Economics, 1996,

55(4): 351-368.

[5]

Roback, J. Wages, rents, and

the quality of life [J]. Journal of

Political Economy, 1982, 90(6): 1257-1278.

[6]

He, M., Ke, S. Z., Wen, Y.

Amenities and regional differentials of real estate prices in Chinese cities

[J]. The Theory and Practice of Finance

and Economics, 2009, 300(2): 97-103.

[7]

Song, W. X., Liu, C. H. The

price differentiation mechanism of commercial housing in the Yangtze River

Delta [J]. Geographical Research,

2018, 37(1): 92-102.

[8]

Wang, Y., Wang, D. L., Wang, S.

J. Spatial differentiation patterns and impact factors of housing prices of

China¢s cities [J]. Scientia Geographica Sinica, 2013, 33(10): 1157-1165.

[9]

Wang,

S. J., Wang, Y., Lin, X. Q, et al.

Spatial differentiation patterns and influencing mechanism of housing prices in

China: Based on data of 2872 counties [J].

Acta Geographica Sinica, 2016, 71(8): 1329-1342.

[10]

Liu, J. The research on

convergence and its factors of urban housing prices in Pearl River Delta city

clusters [D]. Guangzhou: South China University

of Technology, 2018.

[11]

Zhang, N. N. A study on the

factors of house prices in Beijing-Tianjin-Hebei Region [D]. Changchun: Jilin

University, 2017.

[12]

Wen, H. Z., Tao, Y. L.

Polycentric urban structure and housing price in the

transitional China: evidence from Hangzhou [J]. Habitat

International, 2015, 46: 138-146.

[13]

Zhang, S. Y., Song, X. Q., Den,

W. Impact of public services on housing prices in different functional spaces:

a case study of metropolitan Chengdu [J]. Progress

in Geography, 2017, 36(8): 995-1005.

[14]

Ma, Y. Z., Li, X. L., Song, W.

X. Geographic information dataset of urban housing price change in Yangtze

River Delta Region (2008-2018) [DB/OL]. Global Change Research Data Publishing

& Repository, 2019. DOI: 10.3974/geodb.2019.04.17.V1.

[15]

GCdataPR Editorial Office. GCdataPR data sharing

policy [OL]. DOI: 10.3974/dp.policy.2014.05 (Updated 2017).

[16]

Quigley, J. Consumer choice of

dwelling, neighborhood and public services [J]. Regional Science and Urban Economics, 1985, 15(1): 41-63.

[17]

Groves, J. R., Rogers, W. H.

Effectiveness of RCA institutions to limit local externalities: using

foreclosure data to test covenant effectiveness [J]. Land Economics, 2011, 87(4): 559-581.

[18]

Nanda, A., Ross, S. L. The impact of property condition

disclosure laws on housing prices: evidence from an event study using

propensity scores [J]. Journal of Real

Estate Finance and Economics, 2012, 45(1): 88-109.